Brookshire Tx Property Tax Rate . To get information on the value of your property,. The tax office is not responsible for assessing the value of your home or business. Taxes are due by january 31st without penalty and interest. The city of brookshire contracts with assessments of the southwest for tax assessing and collection services. Property taxes in brookshire totaled $12.0m across these properties, with an average homeowner paying $3,033 in property taxes. Tax rates are assessed per. The median property tax (also known as real estate tax) in waller county is $1,968.00 per year, based on a median home. Tax rates are usually set in september and tax bills are mailed out in october. Tax rates are set by the individual taxing entity.

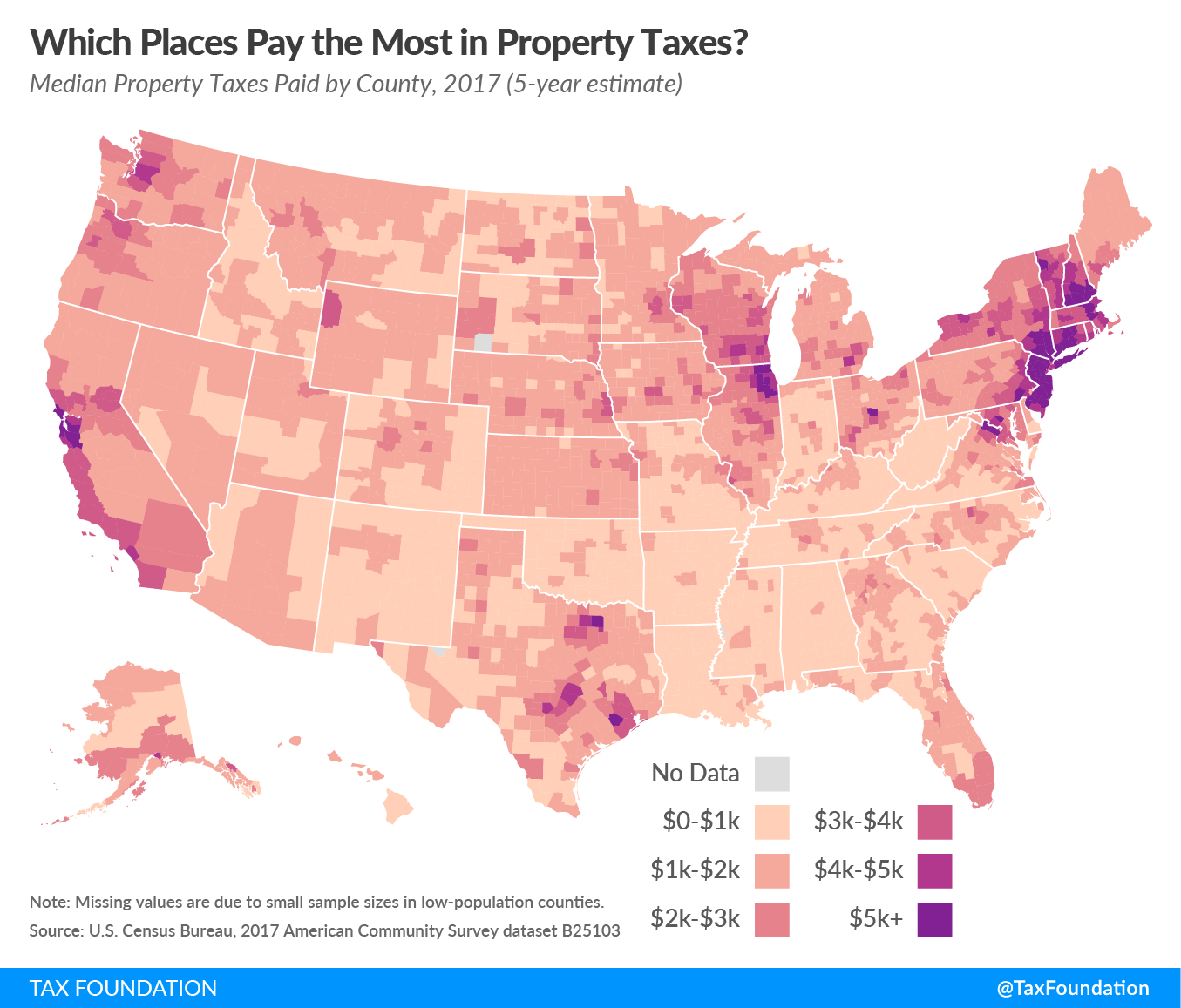

from taxfoundation.org

The city of brookshire contracts with assessments of the southwest for tax assessing and collection services. The tax office is not responsible for assessing the value of your home or business. The median property tax (also known as real estate tax) in waller county is $1,968.00 per year, based on a median home. Property taxes in brookshire totaled $12.0m across these properties, with an average homeowner paying $3,033 in property taxes. Taxes are due by january 31st without penalty and interest. Tax rates are usually set in september and tax bills are mailed out in october. Tax rates are set by the individual taxing entity. To get information on the value of your property,. Tax rates are assessed per.

Property Taxes by County Interactive Map Tax Foundation

Brookshire Tx Property Tax Rate The tax office is not responsible for assessing the value of your home or business. Taxes are due by january 31st without penalty and interest. To get information on the value of your property,. The tax office is not responsible for assessing the value of your home or business. The median property tax (also known as real estate tax) in waller county is $1,968.00 per year, based on a median home. Property taxes in brookshire totaled $12.0m across these properties, with an average homeowner paying $3,033 in property taxes. Tax rates are assessed per. Tax rates are usually set in september and tax bills are mailed out in october. Tax rates are set by the individual taxing entity. The city of brookshire contracts with assessments of the southwest for tax assessing and collection services.

From www.houstonproperties.com

Del Webb Fulshear Homes For Sale & Real Estate Trends Brookshire Tx Property Tax Rate The city of brookshire contracts with assessments of the southwest for tax assessing and collection services. Tax rates are assessed per. Tax rates are set by the individual taxing entity. The tax office is not responsible for assessing the value of your home or business. Tax rates are usually set in september and tax bills are mailed out in october.. Brookshire Tx Property Tax Rate.

From www.msn.com

10 Worst States in America for Property Taxes Brookshire Tx Property Tax Rate Property taxes in brookshire totaled $12.0m across these properties, with an average homeowner paying $3,033 in property taxes. To get information on the value of your property,. The city of brookshire contracts with assessments of the southwest for tax assessing and collection services. The tax office is not responsible for assessing the value of your home or business. Taxes are. Brookshire Tx Property Tax Rate.

From www.loopnet.com

11107 FM 359, Brookshire, TX 77445 Land for Sale Brookshire Tx Property Tax Rate Taxes are due by january 31st without penalty and interest. The tax office is not responsible for assessing the value of your home or business. Tax rates are usually set in september and tax bills are mailed out in october. Property taxes in brookshire totaled $12.0m across these properties, with an average homeowner paying $3,033 in property taxes. Tax rates. Brookshire Tx Property Tax Rate.

From www.crosscreektexas.com

Fulshear — the Safest City in Texas Brookshire Tx Property Tax Rate Tax rates are assessed per. To get information on the value of your property,. Tax rates are set by the individual taxing entity. The tax office is not responsible for assessing the value of your home or business. Tax rates are usually set in september and tax bills are mailed out in october. The city of brookshire contracts with assessments. Brookshire Tx Property Tax Rate.

From byjoandco.com

Property Tax Rates in Katy TX Jo & Co. Not just your REALTOR®, your Brookshire Tx Property Tax Rate The tax office is not responsible for assessing the value of your home or business. The city of brookshire contracts with assessments of the southwest for tax assessing and collection services. Tax rates are usually set in september and tax bills are mailed out in october. Property taxes in brookshire totaled $12.0m across these properties, with an average homeowner paying. Brookshire Tx Property Tax Rate.

From www.texaspolicy.com

Reduce Texas’ Soaring Property Taxes by Embracing Sound Budgeting Brookshire Tx Property Tax Rate Tax rates are set by the individual taxing entity. Tax rates are assessed per. Property taxes in brookshire totaled $12.0m across these properties, with an average homeowner paying $3,033 in property taxes. To get information on the value of your property,. The median property tax (also known as real estate tax) in waller county is $1,968.00 per year, based on. Brookshire Tx Property Tax Rate.

From www.loopnet.com

204 S Waller Ave, Brookshire, TX 77423 I 10 359 Brookshire Tx Property Tax Rate Taxes are due by january 31st without penalty and interest. To get information on the value of your property,. The median property tax (also known as real estate tax) in waller county is $1,968.00 per year, based on a median home. Tax rates are set by the individual taxing entity. Tax rates are assessed per. The tax office is not. Brookshire Tx Property Tax Rate.

From taxfoundation.org

Property Taxes by County Interactive Map Tax Foundation Brookshire Tx Property Tax Rate Tax rates are usually set in september and tax bills are mailed out in october. Taxes are due by january 31st without penalty and interest. The median property tax (also known as real estate tax) in waller county is $1,968.00 per year, based on a median home. Tax rates are set by the individual taxing entity. The tax office is. Brookshire Tx Property Tax Rate.

From dorislwallxo.blob.core.windows.net

What Is The Property Tax Rate In Celina Texas Brookshire Tx Property Tax Rate Taxes are due by january 31st without penalty and interest. Tax rates are usually set in september and tax bills are mailed out in october. Tax rates are set by the individual taxing entity. The city of brookshire contracts with assessments of the southwest for tax assessing and collection services. Property taxes in brookshire totaled $12.0m across these properties, with. Brookshire Tx Property Tax Rate.

From nataliewirina.pages.dev

Texas Property Tax Increase 2024 Alicia Meredith Brookshire Tx Property Tax Rate Property taxes in brookshire totaled $12.0m across these properties, with an average homeowner paying $3,033 in property taxes. The city of brookshire contracts with assessments of the southwest for tax assessing and collection services. Tax rates are set by the individual taxing entity. The median property tax (also known as real estate tax) in waller county is $1,968.00 per year,. Brookshire Tx Property Tax Rate.

From www.cleveland.com

Property tax rates increase across Northeast Ohio Brookshire Tx Property Tax Rate Property taxes in brookshire totaled $12.0m across these properties, with an average homeowner paying $3,033 in property taxes. Tax rates are usually set in september and tax bills are mailed out in october. To get information on the value of your property,. Tax rates are assessed per. The tax office is not responsible for assessing the value of your home. Brookshire Tx Property Tax Rate.

From nataliewirina.pages.dev

Texas Property Tax Increase 2024 Alicia Meredith Brookshire Tx Property Tax Rate Tax rates are assessed per. Tax rates are set by the individual taxing entity. The tax office is not responsible for assessing the value of your home or business. The city of brookshire contracts with assessments of the southwest for tax assessing and collection services. Tax rates are usually set in september and tax bills are mailed out in october.. Brookshire Tx Property Tax Rate.

From mavink.com

Texas County Tax Rates Map Brookshire Tx Property Tax Rate The median property tax (also known as real estate tax) in waller county is $1,968.00 per year, based on a median home. Tax rates are usually set in september and tax bills are mailed out in october. Taxes are due by january 31st without penalty and interest. The tax office is not responsible for assessing the value of your home. Brookshire Tx Property Tax Rate.

From www.eathappyproject.com

Converse, TX Property Tax Rate Ultimate Guide EatHappyProject Brookshire Tx Property Tax Rate Tax rates are assessed per. Property taxes in brookshire totaled $12.0m across these properties, with an average homeowner paying $3,033 in property taxes. The city of brookshire contracts with assessments of the southwest for tax assessing and collection services. Tax rates are set by the individual taxing entity. To get information on the value of your property,. The tax office. Brookshire Tx Property Tax Rate.

From www.har.com

Master Planned Communities in Fulshear, Texas Brookshire Tx Property Tax Rate To get information on the value of your property,. Tax rates are assessed per. Tax rates are usually set in september and tax bills are mailed out in october. The tax office is not responsible for assessing the value of your home or business. Taxes are due by january 31st without penalty and interest. Tax rates are set by the. Brookshire Tx Property Tax Rate.

From www.texasrealestatesource.com

What State Has the Lowest Property Tax? How Texas Compares Brookshire Tx Property Tax Rate Tax rates are set by the individual taxing entity. The tax office is not responsible for assessing the value of your home or business. Taxes are due by january 31st without penalty and interest. To get information on the value of your property,. The median property tax (also known as real estate tax) in waller county is $1,968.00 per year,. Brookshire Tx Property Tax Rate.

From byjoandco.com

Property Tax Rates in The Woodlands TX Jo & Co. Not just your Brookshire Tx Property Tax Rate Taxes are due by january 31st without penalty and interest. The tax office is not responsible for assessing the value of your home or business. Property taxes in brookshire totaled $12.0m across these properties, with an average homeowner paying $3,033 in property taxes. Tax rates are usually set in september and tax bills are mailed out in october. The city. Brookshire Tx Property Tax Rate.

From byjoandco.com

Property Tax Rates in Katy TX Jo & Co. Not just your REALTOR®, your Brookshire Tx Property Tax Rate Property taxes in brookshire totaled $12.0m across these properties, with an average homeowner paying $3,033 in property taxes. Tax rates are assessed per. The city of brookshire contracts with assessments of the southwest for tax assessing and collection services. To get information on the value of your property,. The median property tax (also known as real estate tax) in waller. Brookshire Tx Property Tax Rate.